Table of Contents

INTRODUCTION

A Subsidy is the form of financial aid or support extended to an individual or a business for promoting an economic and social policy. In other words subsidy is cash and kind payment that is paid by government or public body to make something such as goods and services cheaper to buy, use or produce. Also the subsidy is a discount given by government to make available the essential items to public at affordable price. Almost every country around the world provide subsides as a tool for realising their government policies. The subsidies are often given to public and many entities in various sectors like agriculture, education, LPG , food etc. Mid-day meal programs, healthcare, women empowerment, farm loan waiver, Rural Employment generation Scheme etc. are some notable examples of Subsidies. Presently, we are getting around 40% subsidy on the price of a LPG cylinder in India.

The subsidies can often be used by a countries to aid market failures with a view to enhance their economic efficiency. In the growing face of globalization where large number of multinational companies enter markets of a economy, it comes with a great challenge to the domestic producers of that economy to maintain and survive in the market. Subsidy programs but the government supports such struggling industries of the economy by encouraging their development by way of financial support . In such cases subsidies act as a barrier to trade by hampering the competitive relationship that develop naturally in a free trading system. The question herein arise that to what extent the government of a nation can provide subsidies so that it do not distort the competitive market system in the world economy. The WTO-Agreement on Subsidies and Countervailing Measures was entered amongst the member states to maintain harmony in the international trade by establishing compromise between the possibility for governments to apply subsidies and restrictions imposed by international trade law fits well into the general picture of the WTO legal system’s overall structure.

AGREEMENT ON SUBSIDIES AND COUNTERVAILING MEASURES

ORIGIN

The origin of Agreement on Subsidies and Countervailing measures can be traced in the GATT treatment of subsidies under Article VI and XVI of the Agreement on GATT, 1947. The treatment of Subsidies under GATT has been controversial and received great criticism due to weak discipline. The term subsidy was nowhere defined under the Article XVI of GATT 1947. Rather, it was first time defined under Article 1 of the Agreement on Subsidies And Countervailing Measures. ASCM was accepted by the member nations in the Tokyo round ( 1973-1979 ).

DEFINITION OF SUBSIDIES UNDER ASCM

The term subsidy for the first time was defined under Article 1 of the Agreement on Countervailing Measures(ASCM).

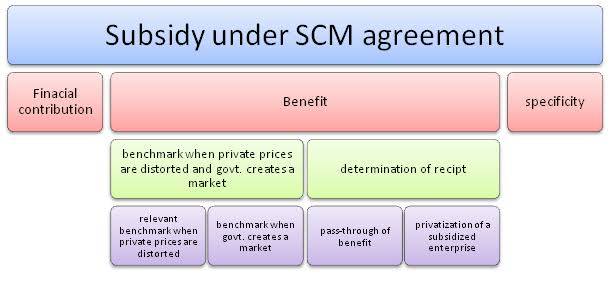

According to Article 1 of the ASCM , a subsidy is deemed to exist if following conditions are fulfilled:

- There shall be a financial contribution by government or any public body in the form of income or price support.

- A benefit must be conferred which make the receiver better off.

The types of financial contributions provided under Article 1.1(1)(a) are given below:

- Direct transfer of funds by government such as loans, grants etc.

- Potential direct transfer of funds and liabilities such as loan guarantee.

- Government revenue which is due but forgone or not collected such as tax credits.

- Goods and services provided by government other than general infrastructure.

- Goods purchased by government.

- Payments made by government to funding mechanism or entrustment or direction of private body.

CATEGORIES OF SUBSIDIES

RED-LIGHT SUBSIDIES-

These subsidies are classes as prohibited subsidies under ASCM. Article 3 of the agreement provides that Red-Light subsidies shall be avoided except under certain cases such as for developing and developed nations and average economies to attain growth. These types of subsidies are subject to remedies in case they are granted . Red-light subsidies are further classified under two export subsidies and subsidies for encouraging use of domestic goods or services over imported goods.

YELLOW-LIGHT SUBSIDIES-

These type of subsidies are not prohibited under the agreement. However, in case these subsidies cause inimical effect, as such effect cause prejudice to the traders of the other countries, then these subsidies shall be subjected to remedies.

GREEN-LIGHT SUBSIDIES-

According to Article 8 of the agreement, these type of subsidies are not prohibited and also they are not subject to remedies or countervailing measures. These type of subsidies are not specific and may be granted for special program or project of the particular country. National research and development subsidies, regional subsidies, education subsidies, etc. are the examples of Green-Light Subsidies.

COUNTERVAILING MEASURES

Countervailing measures are given under Part 5 of ASCM. It provides that certain significant conditions shall be fulfilled if the countries wants to impose a countervailing measure. A member shall not impose countervailing measure until and unless it actuate there are subsidized imports, harm to domestic producer and a nexus between subsidized product and the harm.

Part 5 of the agreement provides specific rules for manage countervailing investigation, imposition of preliminary and final measures and the duration for which measures will be applicable. The main aim of these rules is to establish unbiased and transparent investigation and authorities appropriately explain the basis of their decision.

The agreement on subsidies and countervailing measures(ASCM) came up with some innovative rules for dealing with countervailing measures available to the members. The agreement provides the number of circumstances where there is enough base for domestic industry for starting an investigation. The preliminary measures are to be imposed, the agreement also provides for conducting preliminary investigation. The ASCM directs to abort the countervailing measures after a period of five years. However, the countervailing measures can be continued if it is determined that it is necessary for avoid recurrence of the injurious subsidization. The agreement also provides for creation of independent tribunal by the members, to review the consistency of determination investigating authority with domestic law of the members.

REMEDIES UNDER ASCM

The Remedies are provides under Article 4 of the Agreement on Subsidies and Countervailing Measures. The provision defines the procedure to be followed for availing remedies against injurious subsidization.

The remedial procedure starts when the a member has reasons to believe that the another member had granted prohibited subsidy. The aggrieved member may send requisition to other member for a course of discussion on the matter. The said requisition shall be coupled with statement of available evidence regarding the nature and existence of subsidy in question. The such other member join such consultation as early as possible so that the very purpose of consultation i.e to arrive at mutual solution, may be fulfilled.

If the members do not arrive at a mutual solution within 30 days, the member shall refer the matter to Dispute Settlement Body for establishment of panel. After the establishment, the panel may request the assistance of Permanent Group of Experts with regard to determination of prohibited subsidy in question. The PGE shall review the evidence of prohibited subsidy in question and shall provide opportunity to such other member maintaining subsidy to show that the subsidy in question is not a prohibited subsidy. PGE shall submit its conclusion to the to the panel within the time determined by the panel and panel shall accept the conclusion of PGE without modification. After PGE’s conclusion is accepted, the panel shall submit its final report to the members within 90 days.

In case the subsidy in question found to be prohibited subsidy, the panel shall recommend the subsidizing member to withdraw the subsidy within specified period of time. A member aggrieved by the report of the panel can file an appeal before in the appellate body within 30 days of issuance of panel’s report. The members to dispute can also request arbitration under paragraph 6 of the Dispute Settlement Understanding and the arbitrator shall determine the dispute in question.

In CANADA Aircraft Case – Brazil Claimed that Canada is providing various forms financial support to domestic civil aircraft industry. The claim includes that export credits are being provided to Canada’s regional aircraft industry. Brazil was of the view that the aforesaid export credits are subsidies within the meaning of Article 1 of ASCM and it is violation of Article 3 of the agreement. In 2001 Brazil requested the consultation but the consultation failed. The matter was referred to panel and the Panel concluded that the EDC programme as such was discretionary legislation and, upon examination of its application, found no prima facie case that these were export subsidies. The panel recommended the Canada to withdraw the subsidies within 90 days.

Author: Lalit Mohan,

Delhi Metropolitan Education,GGSIPU ( 4th year )