Table of Contents

Distribution of powers between the Centre and State

Distribution of powers is an essential feature of federalism. The basic principle of federalism is that the legislature, administrative and financial authority is divided between Centre and State by Constitution.

A) Legislative Relation

B) Administrative Relation

C) Financial Relation

A) Legislative Relation

The Constitution of India makes the two-fold distribution of legislative powers.

i)With respect to the territory

ii)With respect to the subject matter

i) With respect to the territory

Parliament may make laws for the whole or any part of the territory of India. The legislative powers of Parliament and State Legislatures are subject to the provisions of the Constitution.1) the scheme of the distribution of powers. 2) Fundamental rights. 3) other provisions of the Constitution.

Delegated Legislation

Delegated or subordinate legislation may be defined as rules of law made under the authority of an Act of Parliament. Delegated legislation exists in the form of rules, regulations, orders or bye-laws.

Factors responsible for the growth of delegated legislation: –

- Pressure on Parliamentary time– Parliament being a busy body has insufficient time to deal adequately with the increasing mass of legislation necessary to regulate affairs of a complex modern State.

- Technical Issues– Technicalities of modern legislation require expert knowledge of problems which is not expected of the legislators in the legislature which are composed of politicians.

- Opportunity for experimentation– Delegated legislation is more flexible, easily amendable and revocable than ordinary legislation. There is enough scope for experimentation.

- Unforeseen contingencies- Subordinate legislation enables a Government to deal with problems which could not be foreseen when the ‘enabling Act’ was passed and to act quickly in an emergency.

- Emergency powers– During the emergency quick and decisive action is necessary at the same time it is kept confidential. The legislature is not fit to serve this end and therefore the executive has delegated the power to make rules to deal with such situations.

ii) With respect to the subject matter

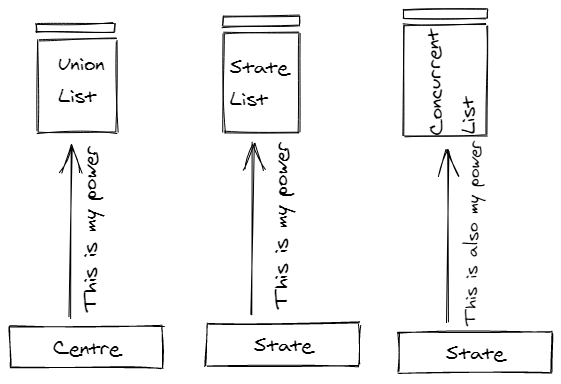

The present Constitution adopts the method followed by the Government of India Act, 1935 and divides the powers between the Centre and State in three lists.

a) Union List

b) State List

c) Concurrent List

The subjects mentioned in the Union List are of national importance, i.e. defence, foreign affairs, union duties and taxes etc.

The subjects mentioned in the State List are of local importance, i.e. public order, local government, State tax and duties etc.

Both Centre and State can make laws on the subject mentioned in the Concurrent List. But in case of conflict between the Centre and State la won current subject, the Central law will prevail. The framers added this list to the Constitution with a view to secure uniformity in the main principles of law throughout the country.

B) Administrative Relation

- The executive power of every State is to be exercised as to ensure compliance with the laws made by Parliament and any existing laws which apply in that State.

- It should not be prejudiced to the executive power of the Centre.

- Centre enjoys superior powers and privileges.

- During emergencies, the State administration comes under the superintendence, direction and control of the Centre.

- Centre’s power to create or abolish an All India Service.

- It is the duty of the Centre to protect states against external aggression and internal disturbances.

- It is the responsibility of every State government to protect central properties in their territory.

C) Financial Relation

Financially, the States are dependent on the Centre to a large extent. The states have to look at the centre for grant-in-aid.

Taxation only by authority of law- The law providing for the imposition of tax must be valid law, that is, it should not be prohibited by any provisions of the Constitution. Thus, the tax law will be void if it violates the fundamental rights to equality guaranteed by Article 14.

The following categories of Union taxes which are wholly or partially assigned to the States:

- Duties levied by the Union but collected by the States.

- Service tax levied by Union and collected by Union and States.

- Taxes levied by the Union and assigned to the States

- Taxes levied by the Union but distributed between the Union and States

- Taxes for the purpose of the Union and States.

- Grants-in-aid.

Doctrines of Constitution of India:

1) The doctrine of repugnancy

Art 254(1) says that if any provision of law made by the legislature of the State is repugnant to any provision of a law made by Parliament which is competent to enact any provision of the existing law with respect to one of the matters enumerated in the Concurrent List, then the law made by the Parliament, whether passed before or after the law shall prevail and law made by the State shall be void. Art 254(2) State law with respect to any of the matters enumerated in the Concurrent List contains any provision repugnant to the provisions of an earlier law made by Parliament or the State law has been received the assent of President, it shall prevail. But it is possible for the Parliament under clause (2) to override the law on the same matter.

2) Doctrine of Colourable Legislation-

The whole doctrine is based on the concept that what you cannot do directly, you cannot do it indirectly. The legislature cannot violate the constitutional prohibition by employing the indirect method.

3) Doctrine of Pith and Substance

Pith means the “true nature” and substance means essential nature underlying a phenomenon. Thus, the doctrine relates to finding out the true nature of the statute.

In-State of Bombay v. F.N. Balsara, the State Legislature passed the law as Bombay Prohibition Act, ” The Prohibited the manufacture, transportation, purchase or sale of intoxicating liquor”. This law was challenged in Parliament. The Parliament held that was a transgression of power.

Author: Shreya Potdar,

S.N.D.T LAW COLLEGE