Table of Contents

Law of Succession in Muslim Law

INTRODUCTION

Succession refers to how the earthly property of a deceased is distributed as per law or the will left behind by the deceased. Inheritance is the transfer of rights of property from the dead person to a successor. In other words, succession results in inheritance. The Muslim Personal law or the Shariat Law deals with marriage, property rights, charity and other personal subjects. These property rights include laws on inheritance and succession that become cardinal when wealth and property are transferred from one generation to another. In Islam, succession is known as Mirth, Irth or Farid.

Farid denotes the fixed shares of inheritance allocated to the legal heirs by the Qur’an and Sunnah. Here, the legal heir (Warith) is a term applied only to those relatives to whom the property is transferred after the death of its owner (by the operation of law). The estate comprises all the property (movable and immovable) that the deceased owned during his lifetime, passed on to the next generation.

The duties to be performed when a Muslim dies are:

- Pay funeral and burial expenses.

- Paying debts of the deceased.

- Determine the value/will of the deceased (which can only be a maximum of one-third of the property).

- Distribute the remainder of estate and property to the relatives of the deceased according to Shariah Law.

SOURCES OF MUSLIM SUCCESSION LAW

- Holy Quran: Holy book for Muslims. In other words, the central religious text of Islam, believed by Muslims.

- Sunnah: It is a body of social and legal customs or practices followed by Muslims.

- Ijma: It is the third most fundamental source of Sharia Law. In Islam, ijma means “consensus of the learned men over the decision over a particular subject matter” or an infallible agreement.

- Qiya: an analogical deduction of what is right and just as per the sound principles laid down by God.

HEIRS AND THEIR TYPES

As per the Muslim law of succession, heirs are always entitled to a share of the inheritance. These primary heirs consist of the spouse, which includes both parents, the son and the daughter. However, under certain circumstances, other heirs can also inherit as residuary. Those who inherit are usually classified under three groups:

- Quota-heirs (dhawu al-farā ) usually include daughters, parents, grandparents, husband and wife/ wives, brothers and sisters, and others. This group usually takes a designated share or quota of the estates.

- Members of the Asaba (residuary), usually a combination of male (and sometimes female) relatives that inherit as residuary after the shares of the Quota-heirs is distributed.

- If a person leaves no direct relatives and there is no will, his property escheats to the state treasury (Bayt al-mal).

Muslim personal law recognises two types of heirs, namely, sharers, who are entitled to a certain share of the deceased’s property and residuary, who would take up the share in the property after the sharers have taken their part.

The Sharers are twelve in number totally and include husband, wife, daughter, daughter of a son (or son’s son), father, paternal grandfather, mother, grandmother on the male line, full sister, consanguine sister, uterine sister, and uterine brother.

The part taken by each sharer varies according to the conditions. For instance,

- A wife takes ¼th of the share if the couple is without lineal descendants and a one-eighth share with lineal descendants.

- A husband (in the case of succession to the wife’s estate) takes half the share if the couple is without a lineal descendant and a one-fourth share if otherwise.

- A single daughter takes a half share. However, if the deceased has left behind more than one daughter, all daughters jointly take two-thirds of the share.

- Suppose the deceased has left behind a son(s) and daughter(s). In that case, the daughters cease to be sharers and instead become residuary, with the residue being distributed to ensure that each son gets double what each daughter receives.

GENERAL PRINCIPLES OF SUCCESSION AND INHERITANCE OF MUSLIM LAW

-

Nature of Heritable Property

Heritable property is that property that remains for legal heirs after using the deceased’s property to pay the funeral expenses, debt, and legacies/will. According to Muslim law, there is no distinction between movable and immovable property in the case of inheritance. Any property in the ownership of the deceased at the time of death may be subject to inheritance.

-

Joint or Ancestral Property

Under the Muslim law of succession, there is no provision for any ancestral or joint-family property. Instead, all properties, whether acquired by a Muslim himself or inherited by his ancestors, are regarded as individual property. Subsequently, this may be inherited by his legal heirs. In Abdul Raheem v. Land Acquisition Officer[1], the judicial verdict held that “the joint system family or joint property is unknown to Muslim law. Therefore, the right, title and interest in the land held by the person stands extinguished and stands vested in other persons.”

-

No Birth-Right

Unlike Hindu law, the Muslim law of inheritance does not recognise the concept of ‘right by birth’ (Janmaswatvavad). Under Muslim law, an heir does not possess any right before the death of an ancestor. Therefore, the right of succession or inheritance opens only after the property owner’s death. Till then, the heirs have merely a ‘chance of succession’.

-

Doctrine of Representation

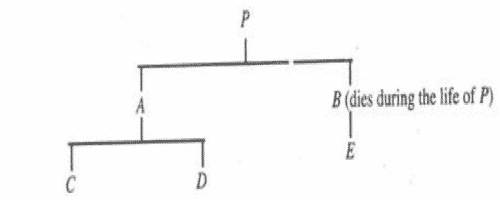

Under the principle of representation, the son of a predeceased son represents his father for inheritance. The principle of representation may be explained with the help of the diagram given below.

P has two sons A and B. A has got two sons С and D, and В has a son, E. During the life of P, his family members are his two sons (A and B) and three grandsons (C, D and E). Unfortunately, В pre-deceases P, i.e. В dies before the death of P. Subsequently, when P also dies, the sole surviving members of the family of P are A and three grandsons, C, D and E. Under the doctrine of representation, E will represent his predeceased father В and would be entitled to inherit the properties of P in the same manner as В would have inherited had he been alive at the time of P’s death. However, unlike Hindu law, Muslim law does not recognise the doctrine of representation. Therefore, under Muslim law, the nearer heir excludes a remoter heir from inheritance.

-

Distribution of Property

Under Muslim law, the distribution of property is different for Sunni and Shia law. The property can be distributed in two ways, i.e. per capita or per strip distribution. In Sunni law, the per capita distribution method is majorly used. As per this method, the estate left over by the ancestors gets equally distributed among the heirs. Therefore, the quantum of inheritance is determined by the number of heirs. However, in Shia law, the per strip distribution method is recognised. According to this method of inheritance, the property gets distributed among the heirs according to the strip they belong to. Hence the quantum of their inheritance depends upon the branch and the number of persons that belong to the branch. It is noteworthy to say that in Sunni law, the principle of representation is recognised neither in the matter of determining the claim of an heir nor in determining the quantum of share of each heir.

-

Female Rights of Inheritance

As per Muslim law, males and females have equal rights of inheritance. However, the shares of males are double the share of females. In other words, though males do not have any preferential rights over women. Moreover, though there is no difference between male and female heirs while concerning their inheritance rights, the property inherited by a female heir is usually half of the property given to a male of equal status.

- Under Muslim law, all sons are treated equally; hence, the rule of primogeniture is not recognised. However, under Shia law, if the eldest son is of sound mind, then he has the exclusive right to inherit his father’s garments, sword, ring and copy of the Quran.

-

Rights of Widows

Under Sharia Law, a widow is entitled to a share of the property which belonged to her deceased husband. The widows share is one-fourth if her husband leaves no child, but she gets an eighth if he leaves a child.

Allah said in the Holy Quran, “And for the wives is one fourth if you leave no child. But if you leave a child, then for them is an eighth of what you leave.”

GROUNDS OF DISQUALIFICATIONS

The grounds which debar the heirs to succeed the property of the intestate are—

- Murderer: As per Sunni law, a person who causes death, whether intentionally or by negligence, is debarred from inheriting the estate. However, homicide is not a ground to debar a person from his succession under Shia law unless the death was caused intentionally.

- Illegitimate children: According to the Hanafi school, an illegitimate child cannot inherit from his/her father but can inherit from his/her mother and maternal relatives.

- Children in the womb: A child in the mother’s womb, if not born alive, is considered not to be a legal heir resulting in no succession. In other words, a child in the womb of its mother is competent to inherit only if it is born alive.

- Escheat: When the deceased does not have any legal heir recognised by the law (Muslim law), then in such a case, the person’s property is inherited by the government by the process of escheat.

CASE LAWS

In Hakim Rehman v. Mohammad Mahmood Hassan [2], It was held that “The legal position in the Muhammadan law is that upon the death of a Muhammadan the whole estate devolves upon his heirs at the moment of his death and the heirs succeed to the estate as tenants-in-common in specific shares. It is also established that each heir of a Muhammadan is liable for the debts of the deceased to the extent only of a share of the debts proportionate to his share of the estate.” [3]

In Rukmanibai v. Bismillavai [4], the court held that if a person, who converted to Islam, dies leaving behind his daughter, she will not be entitled to her share and the residuary share in the property of the deceased.

CONCLUSION

“Learn the laws of Succession and teach them to people, for they are one half of the useful knowledge”———-Prophet Mohammed.

Quite a lot of efforts are being put to codify the laws on succession and inheritance of property. However, in India, Muslims still do not have codified property rights but are instead broadly governed by either the Hanafi/Sunni or Shia sects. There are still lots of cases pending before the courts dealing with Muslim succession. Therefore, there is a need to codify property rights under Muslim law to create an effective and efficient system of succession or inheritance.

[1] AIR 1989 AP 318.

[2] AIR 1957 Pat 559

[3] Sections 1 and 43 Mulla’s Mo-hammadan Law, 13th edition, at pages 32 and 35

[4] AIR 1993 MP 45

Author: Prarthana Vasudevan,

Christ (Deemed to be University), 1st year B.A. L.L.B