Table of Contents

Restraint of Trade and Monopolies under British Empire

The earliest appearance of the doctrine of Restraint of Trade can be traced back to the case which has established itself as a founding precedent- Dyer’s Case (1414). In this case, an action was bought on a sealed obligation containing a provision that it should be void if other party did not pursue his trade of dyer within the town where he had formerly carried on such a business for a period of six months. It has provided the base for an attempt by courts to reconcile the freedom to trade with the freedom to contract. The doctrine of restrictions on trade is contractually imposed on competition such as cartels. Unless such contractual restrictions are reasonable in the interests of the parties and is not unreasonable in the public interest; they are not enforceable in legal proceedings.

Applicability of the Doctrine

A restraint is identified where the parties agree that one party will “restrict his liberty in the future to carry on trade with other persons not parties to the contract in such manner as he chooses. The application of this doctrine is primarily on contracts of employment and partnership contracts that impose restrictions on the activities in which the employees and partners may engage after the termination of their employment or partnership relationship; and – contracts for the sale of a business that impose restrictions on the activities in which the seller may engage after the transfer has been completed. But the doctrine is also applicable to other contractually imposed restrictions on competition such as cartels and solus petrol ties. Unless the restrictions harm any public interest and are ‘reasonable’ for the transacting parties, they lack legal enforceability. This leaves the third party without any legal remedy. Also, the sole sanction on such contracts is unreasonable restrictions. This prevents the judiciary from getting caught in disputes and discussing on a subjective length the demarcation of restrictions as reasonable or unreasonable. However, the attempts by judiciary to escape from the same have been unsuccessful; On the contrary, they have in a long passage of time helped in evolving this doctrine by weighing it on the scale of reasonable restrictions and public interests. In Esso Petroleum Co Ltd v Harper’s Garage (Stourport) Ltd, three principles were held-

- The doctrine of restraint of trade applies to the person who gives up ‘pre-existing freedom’ when he enters into the covenant.

- The doctrine of restraint of trade does not apply either to a lessee who accepts a negative covenant in a lease or a purchaser of freehold land who accepts a negative covenant in respect of the land he purchases.

- The doctrine of restraint of trade, in respect of both freehold and leasehold land, does not extend to successors in title of the original covenentee and covenantor.

Monopolies under the British

With respect to trading outside British borders, the Court in East India Company v. Sandys found that such exclusive right can be granted if entities were equipped to conduct business overseas, taking into count all challenges posed by foreign lands.

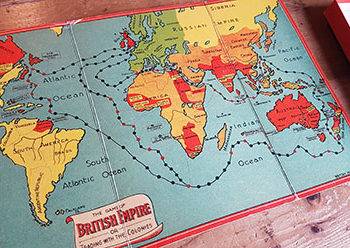

Thus, this allowed for government granted monopolies which could extend their businesses to colonies. Around 1600, Royal Charters were issued to companies by Queen Elizabeth, granting them monopoly over a particular region to control trade of various commodities. For instance, the British East India Company and Dutch East India Company were formed by the Royal Charter issued by Queen Elizabeth I. The Charter allowed these organisations for a 21-year monopoly in conducting trade between East Indies and England. Charters were also issued for monopoly of trade with Asia.

The British Empire, not only impacted governance of colonies under its rule, but also had the power to control its commercial interests in a colony. It favoured its own commercial interests by forming monopolies. Monopolies allowed the British an advantageous position in collecting tax revenues and detection of ships by officials. Detection was necessary to prevent small traders from disguising themselves, thus compelling them to pay custom duties.

Further, prior to the entry of the English, other European nations had established business ties with local traders, thus there was existing competition for the English. Allowing open access to all traders, may not have led to increased profits taking into count the free riding phenomenon. It refers to less profit incentive when a shared resource is utilised by entities not paying an equivalent value for the resource. Thus, to overcome this, adopting a monopoly business model allowed for enhancement of profits. A monopoly was witnessed in various commodities as discussed below:

Opium

Impact of British’s commercial involvement in opium was largely felt in the Asian continent. Opium trade was already flourishing in the market between 1800-1830, whether through legal or illegal market channels, when British East India Company decided to enforce a monopoly over its trade in India. Initially Indian smugglers and traders were established enough to ward off British attempts to monopolise the trade. However, post Revolt of 1857 there was an administrative re-organisation. The Opium Act, 1857 was enacted to regulate cultivation and manufacture of opium. The British East India Company established the Opium Department and all production and sale of opium was done via the State.

Subsequently the Opium Act, 1878 was enacted, further solidifying the British monopoly. Under the provisions of this Act, cultivation, process, transportation, sale was not allowed without prior permission of the British government. Bringing opium under State administration and regulating it strictly allowed British to monopolise the trade.

The monopoly over opium cultivation established in India was utilised to remedy Britain’s trade imbalance with China. Chinese populations’ addiction to opium was on the rise. While there was a demand for Chinese goods in British markets, there was negligent demands for British goods in Chinese markets. Thus, the British decided to sell opium in China. Leveraging their manufacturing in production of Opium in India, the British were able to establish a monopoly in the Chinese distribution channels for opium. The fact that it was done via illegal channels led to two wars amongst the British and Chinese. China lost both the wars and was eventually compelled to legalise the trade.

Sugar

The market for sugar was also an important market in colonies which the British tapped into for profits. The following regulation was introduced:

An important statute was the Navigation Act of 1660 which labelled sugar as an ‘enumerated commodity’ under the. As per the provision of this statue, enumerated goods could only be exported to Britain or its colonies. Thus, such goods were protected from foreign competition and sugar planters enjoyed a monopoly by receiving protection from high import duties.

The Sugar Act of 1764 was also introduced. ]. By this law, duties on sugar and molasses, which were imported to the colonies from non-British Caribbean nations, were also increased. This was done to allow British sugar planters in the West Indies to gain a monopoly in the colonial market. Thus such laws and policies were introduced to incentivise people in colonies to buy British goods and successfully establish a monopoly of the same.

Thus, the British successfully established a monopoly in the sugar trade by introducing various laws and regulation.

Tobacco

Tobacco was the first commodity to be labelled as an ‘enumerated commodity’. A bill was introduced prohibiting growth of tobacco in England and for exclusive imports only from Virginia. Despite the failure of the Bill to be passed, King James by proclamation granted a monopoly in the trade of tobacco. Upon payment of customs for shipment of this crop, access was allowed only to English merchants. Further, not allowing growth of the crop in England prevented tax evasions.

This was also an ideal commodity to put high taxes on, since the price did not seem to substantially affect the consumption, thus ensuring a stable demand.

Prohibitive duties were also placed on the tobacco which was previously imported from the Spanish Indies. As a result, preferred shifting their tobacco plantations, further solidifying Britain’s monopoly. Thus, by ensuring imports from Virginia, coupled with high duties on imports of foreign competitor’s crops, the British were able to ensure a monopoly in the tobacco market.

Tea

The British East India Company had monetarily suffered after its conquests in Bengal. To aid the company it was allowed some ease in trade in the tea market by the passage of the Tea Act of 1773. This allowed the company to easily monopolise the American tea market. Prior to the legislation, the British East India Company had to auction the tea exclusively in London, compelling it to pay taxes. However, this move led to unrest amongst the local tea merchants leading to the Boston Tea party, which was one of the major events in triggering the American Revolution.

The economic prosperity and wealth that Great Britain enjoyed can be traced back to the Charters granting commercial monopoly in trade of various commodities, along with the above discussed, with colonies. In the Ninth Report of Select Committee 1783, it has been noted how commercial monopoly on supply of local goods deterred the commercial prosperity of the colonies. Consequently, on the expiry of these Charters, these established companies by the British empire were largely overtaken by competing businesses, ensuring more players in the market and decrease of profits for the British monopolies.

Overall, during the tenure of the British empire monopolies played an important part in solidifying Britain’s rule and commercial influence over colonies.

Author: Mozammil Ahmad,

Campus Law Centre, University of Delhi, Final Semester LL.B