Table of Contents

Introduction

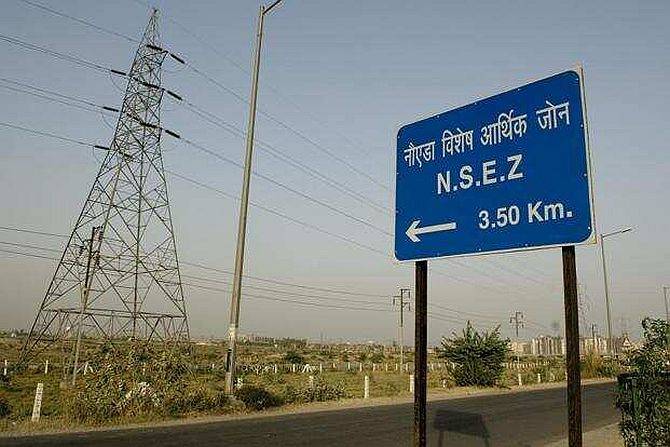

Special Economic Zones or also known as SEZs was created to increase or boost the economy of the country by increase of flow of foreign exchange earnings from other countries into your country by the way of exports from India to other parts of the world by which it attract the foreign currency and will also lead to increase in generation of employment opportunities.

In simpler sayings, SEZs was created and promoted with the only motive to excel in the processes of industrialization and growth in economy as by which it also increases the growth of the country and increases the requirement of jobs by which the Indian youth will get able to achieve more qualitative and quantitative jobs.

Starting foreign parent companies business in earlier times was a bit different in India due to lots of paperwork and old policies and there was a tedious need of new frames of policies by which foreign entrepreneurs don’t like to put their industries in India as any of the entrepreneur will put their money in any other country economy only when he is able to see that his money is able to start get multiplication in some time or has profits or money is safe in that country.

To eliminate these deficiencies of a rickety fiscal regime and to seek more Foreign Direct Investment, Policy of SEZ was created.

This ideology of this policy is to set or formulate a minimum fiscal set up in the the general control of rules and regulations and within controls.

This act not only gives the easy steps and the ways/procedures but also delivered a single window clearances and an easy way of effectively process of documentation with self-certification at both of state and central level.

The motive of the government behind these techniques or policies was not to just attracting the foreign resources to boost the economy of their country but as the other big firms when come to India they brings lots of new technologies with them by which the youth of the country got to know various new techniques or the scope of getting new or creations of jobs to the citizens will also increase and by which there will also lead to rise in the social life of labors.

As in industries there is requirement of more labor by which more industries will lead to creation of more jobs which gives a direct benefit to the India also their population is able to get more jobs by these coming up of the foreign industries.

AREAS IN WHICH SEZ WAS CREATED

SEZ is created in those areas where it is easy to get a geographically demarcated region as by which it enjoys liberal economic laws as compared to other same laws governed in the other parts of the country. SEZs zones are generally considered as specially demarcated duty-free areas where all of the foreign entities were entitled to perform the the tasks of industrialization, as these areas are specifically created d to increase trade practices lots of policies was formulated to boost trade practices in these areas as providing lands at concessional rates, tax exemption for some initial years, reduction in the bills of electricity and water for some years were provided to boost the power of thtfirm in that area.

In corporate languages these zones (SEZ) are also known as “favorite Investment destinations” for foreign companies to get settle their business in this part.

Concept and Origin of SEZ’s

For the very first the time the thought and a fabulous idea of SEZ was a formulated in the Caribbean island Puerto Rico with the business ideology of aiming to attract investment from US. In the year of 1980 China developed SEZs to limelight by setting up the biggest Special economic zone in Shenzhen due to which the economy of their country is going to be boost in a very speedy way.

Moreover now everything is being produced in China from phone chargers to car parts or major companies like to set up their any kind of plant be of car manufacturing, phone manufacturing or etc. in china only as there is lots of population availability in china due to which the corporates firms can get benefit of a cheap and skilled labor.

In year 1965 our country India tried with the idea of Export Processing Zones (EPZ).

Though these EPZs was turned to somehow unsuccessful in achieving the motive due to which they was formulated but in the year 2000, there were change of winds when the policy of Export and Import was set to be allowed in the view of the setting up of SEZ’s in all sectors. Due to which all EPZs were converted into SEZs.

India’s special Act relating to the SEZ originated in 2005 taking country’s foreign investment policy and conversion of EPZs into SEZs for better intake of FDI.

The main features of Special Economic Zones are:

- Geographically marked area.

- Controlled by sole body/authority.

- Enjoying financial and procedural advantages

- Easy, Effective and Efficient measures

- Having distinct custom area

- Ruled by more liberal economic laws.

BACKGROUND OF SPECIAL ECONOMIC ZONES IN INDIA

In the late 1990’s the Union Commerce Minister Murasoli Maran of India visited the Special Economic Zones in China and was highly fascinated by the contributions by the FDI’s in the economy of the china by the foreign companies and they thought these policies should also be implemented in India to inker and boost the Indian economy and raise the level of India in the eyes of the other country’s.

In view of that India created its first export processing zone in Kandala.

Or as the results of EPZs was not very well in india as they thought at the time of creation of them as they was falling down due to various reasons as the way the Indian economy gets a good idea of that Special Economic Zones are to be created to get more effective and profitable working and advanced in technology basis as compared to EPZs.

As compared to the foreign reports theses SEZs zones has added enormously to the growths of employment and foreign direct investment. Their role is always considered as a remarkable point in the developing of the economy of a country in everywhere it is formulated.

Some Important Provisions of the SEZ Act

- Special Economic Zones can be established mainly for manufacturing of the goods, for providing specified circumstances and a free trade and warehousing zone.

- Special Economic Zones will include three types mainly. They are multi-product SEZ, sector specific SEZ, port or airport based SEZ and free trade and warehousing zone.

- They will have their own adjudicating, enforcing and administering agencies. Therefore, absolute non-interference by the state.

- There will be 100% tax exemption and relaxation from strict labour laws.

- They will not have any burden to comply with any sort of minimum obligation to export.

- Except for certain kind of offences, the no investigation or inspection can be carried out in any of the Special Economic Zones without prior approval from the development commissioner.

- The Development Commissioner will be entrusted to the overall administration and supervision of the SEZ and exercise all necessary controls and co operations to foster speedy and effective development of the SEZ concerned. The development commissioner shall be appointed by the central government.

List of some of the Foreign Companies which has latest Set up Their plant in India –

- The biggest manufacture of smartphone SAMSUNG has set up their largest phone manufacturing plant in India at Sector 81 of Noida industrial area.

- KIA motors, car manufacturer has put up their plant in India at Yerramanchi village at Penugonda Mandal of Anantapur district in the state of Andhra Pradesh..

- MORRIS GARAGES motors, car manufacturer has put up their plant in INDIA at Halol in Gujarat.

By coming and setting up these huge scale companies in India there is lots of flow of Foreign capital in India which is helping in boosting the economy of country or also to increase their production they need manpower by which there is creation of job by which Indian youth will has availability of jobs by which they can increase their life status.

REFERENCES

Author: Pushkar Khanna,

Delhi Metropolitan Education affiliated to GGSIPU/ 2nd Year/ Law Student